Do you find it hard to project your savings? It’s tough to guess how much your money will increase over time. A savings interest calculator can help you in taking informed financial decisions. It lets you figure out interest and see your financial future clearly.

With a savings account interest calculator, you can plan your finances better. It helps you see how different savings plans compare. It also shows how compound interest can boost your savings. Don’t let doubt stop you from reaching your savings targets.

Contents

Key Takeaways

- Savings interest calculators help estimate future earnings on deposits

- They factor in initial deposit, interest rate, and compounding frequency

- These tools aid in comparing different savings accounts and options

- Understanding compound interest is crucial for maximising savings growth

- Regular use of calculators can help adjust savings strategies over time

- High-yield savings accounts potentially offer better returns

- Tax implications on savings interest should be considered in calculations

Understanding the Basics of Savings Interest Calculators

Savings interest calculators are great tools for figuring out how much interest you can earn. They show how your savings can grow over time. This helps you make smart choices about your money.

What Is a Savings Interest Calculator?

A savings interest calculator is a digital tool that shows how much you can earn from your savings. It looks at your starting amount, the interest rate, and how long you save. It then shows what your savings might be in the future.

How Does a Savings Interest Calculator Work?

To use a savings interest calculator, you just need to enter a few details. You tell it how much you start with, the interest rate, and how long you plan to save. Then, it uses a formula to work out how much you might earn.

The Role of Savings Interest Calculators in Financial Planning

Savings interest calculators are key for planning your finances. They help you set savings goals, compare options, and see how compound interest works. By using these tools, you can make better choices about saving and reach your financial goals.

| Calculation Type | Formula |

|---|---|

| Simple Interest | A = P x R x T |

| Compound Interest | A = P(1 + R/N)^NT |

Knowing how to calculate interest on your savings helps you make better financial choices. Whether you’re saving for a house, an emergency fund, or retirement, a savings interest calculator is a must-have tool.

Types of Savings Accounts and Their Interest Calculations

It’s important to know about different savings accounts and how they work. This helps you grow your money better. Let’s look at various bank savings accounts and how they can help your money grow.

Traditional Savings Accounts

Traditional savings accounts have lower interest rates. They are good for easy access to your money. Even though the rates are not high, they are safe for keeping your money.

High-Yield Savings Accounts

High-yield savings accounts have higher interest rates. Banks like IDFC FIRST Bank pay interest monthly. This means your money grows faster. But, you need to keep a certain amount or meet certain conditions to get the best rates.

Certificates of Deposit (CDs)

CDs offer a fixed interest rate for a set time. They give higher returns than regular savings accounts. But, you must keep your money locked for that time. The interest is easy to understand, helping you know your earnings.

Money Market Accounts

Money market accounts mix savings and current account features. They often have good interest rates. Rates can go up as your balance increases. Some even come with personal banking cards for easy access.

| Account Type | Interest Rate Range | Compounding Frequency | Accessibility |

|---|---|---|---|

| Traditional Savings | 2.60% to 8.00% per annum | Daily | High |

| High-Yield Savings | 3.00% to 7.50% per annum | Daily/Monthly | Medium |

| Certificates of Deposit | 5.00% to 7.50% per annum | At maturity | Low |

| Money Market | 3.00% to 7.50% per annum | Daily | Medium-High |

When picking a savings account, think about interest rates, how often interest is added, and how easy it is to get to your money. Use a savings account calculator to see which one might be best for you. Remember, putting money in regularly and not taking it out often can really help your balance grow.

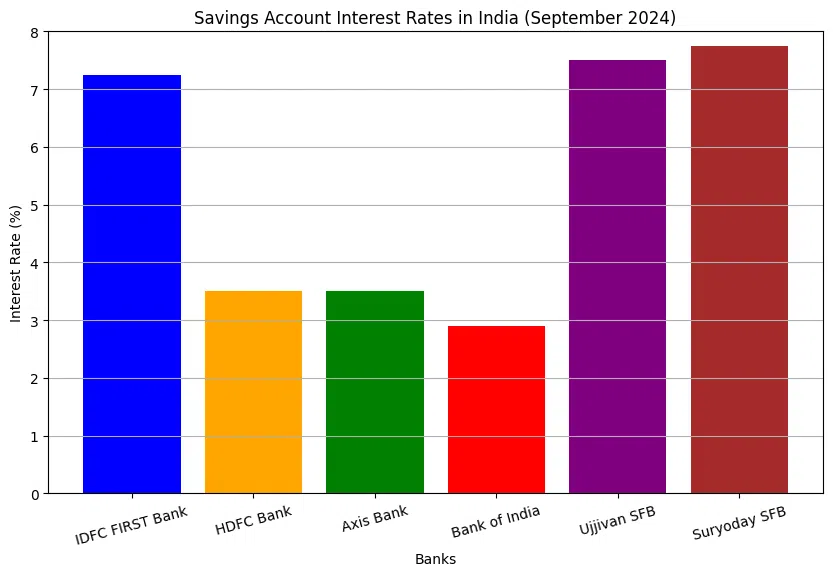

Savings Account Interest Rates in India (September 2024)

- IDFC FIRST Bank: 7.25%

- HDFC Bank: 3.50%

- Axis Bank: 3.50%

- Bank of India: 2.90%

- Ujjivan SFB: 7.50%

- Suryoday SFB: 7.75%

This chart illustrates the interest rates offered by various banks, highlighting the competitive rates available, especially from small finance banks.

Real-Life Examples of Using a Savings Interest Calculator

Savings interest calculators are great for planning your money. They help you reach your savings goals by showing how much you’ll earn in interest. Here are three examples of how these tools are useful.

Saving for a Down Payment on a House

Picture saving for a house in Mumbai. You want to save ₹10 lakh in five years. With a ₹2 lakh start and a 5% interest rate, you’ll need to save about ₹11,242.40 a month.

This helps you adjust your budget and see your savings grow.

Building an Emergency Fund

Having an emergency fund is key for financial security. Say you want to save ₹3 lakhs in two years. With ₹50,000 to start and a 3.5% interest rate, you’ll need to save about ₹10,000 monthly.

Planning for Retirement Savings

For retirement planning, savings calculators are vital. A 30-year-old might aim to retire with ₹2 crores. Starting with ₹1 lakh and saving ₹15,000 monthly could be the plan.

This takes into account compound interest, helping you make smart long-term savings choices.

These examples show how savings interest calculators help you make smart money choices. They give clear views of your savings growth and interest earnings. This makes planning for life’s goals easier.

Benefits of Using a Savings Interest Calculator

A savings interest calculator is a powerful tool for financial planning. It helps you make smart choices about saving money.

Accurate Calculation of Interest Earned

Online interest calculators give you exact figures for what you might earn. For example, if you put ₹10,000 at a 5% annual rate compounded quarterly for ten years, it grows to about ₹16,436.19.

Comparing Different Savings Options

A simple interest calculator makes it easy to compare savings accounts. Look at Ujjivan SFB’s interest rates:

| Balance | Interest Rate (p.a.) |

|---|---|

| Up to ₹1 lakh | 3.50% |

| ₹1 lakh to ₹5 lakhs | 5.00% |

| ₹5 lakhs to ₹25 lakhs | 7.25% |

| Above ₹25 lakhs | 7.50% |

Projecting Future Savings Growth

A compound interest calculator shows how your savings will grow. For instance, ₹1,000 at 5% annually for 10 years becomes ₹1,628.89. This helps set and adjust your savings goals.

Using these tools boosts your financial knowledge. It lets you manage your savings with confidence and precision.

How to Use a Savings Interest Calculator

A savings account interest rate calculator is a powerful tool for financial planning. It helps you calculate potential earnings and make informed decisions about your savings strategy. Let’s explore how to use this valuable resource effectively.

Inputting the Initial Deposit Amount

Start by entering your principal amount. This is the initial deposit you plan to make or the current balance in your savings account. For instance, if you’re starting with Rs 15,000, input this as your deposit amount.

Entering the Interest Rate

Next, input the interest rate offered by your bank. In India, some banks offer rates as high as 7% with special features. Remember, higher interest rates can significantly impact your savings growth over time.

Selecting the Compounding Frequency

Choose how often interest is calculated on your account. This could be daily, monthly, quarterly, or annually. More frequent compounding typically results in higher returns.

Adding Regular Contributions

If you plan to make regular deposits, include this information. Even small monthly contributions can substantially boost your savings over time.

Interpreting the Calculated Results

After entering all details, the calculator will display your potential savings growth. For example, a Rs 15,000 deposit at 8% compound interest over four years would grow to approximately Rs 20,407, earning about Rs 5,407 in interest.

Use these results to compare different scenarios and optimise your savings strategy. Remember, while a savings interest calculator is a useful tool, it’s just one part of your overall financial planning.

Common Mistakes to Avoid When Using Savings Interest Calculators

Savings interest calculators help with financial planning. But, they only work well if used correctly. Let’s look at some common mistakes to avoid. This way, your financial plans will be as accurate as possible.

Incorrect Data Entry

One big mistake is putting in wrong data. A small error in the initial deposit, interest rate, or contributions can cause big problems. Always check your data twice to make sure it’s right.

Ignoring Fees and Taxes

Many people forget about fees and taxes affecting their savings. Some accounts need a minimum balance, with penalties if not met. For example, in India, some accounts need at least ₹1,000.

Overlooking Inflation and Market Fluctuations

Calculators use current interest rates but ignore inflation and market changes. Inflation can reduce your savings’ value over time. Also, interest rates can change, affecting your savings growth. It’s important to keep checking and updating your savings plans.

While many working Indians may feel behind on retirement savings, using calculators wisely can help. Avoiding common mistakes allows you to make better financial decisions for the future.

Making Informed Financial Decisions with a Savings Interest Calculator

A savings interest calculator is a powerful tool for financial planning. It helps you understand how much you can earn on your savings account. This makes it easier to make informed choices about your money.

Evaluating the Impact of Interest Rates on Savings

The interest rate offered significantly affects your savings growth. Let’s look at an example:

| Initial Investment | Monthly Contribution | Interest Rate | Time Period | Total Savings |

|---|---|---|---|---|

| Rs. 1,00,000 | Rs. 10,000 | 5% | 3 years | Rs.4,94,062.50 |

| Rs. 1,00,000 | Rs. 10,000 | 8% | 3 years | Rs. 5,15,234.56 |

| Rs. 1,00,000 | Rs. 10,000 | 12% | 3 years | Rs. 5,43,729.46 |

| Rs. 1,00,000 | Rs. 10,000 | 20% | 3 years | Rs. 6,11,714.28 |

In this scenario, you’d earn Rs. 34,062.50, Rs. 55,234.56, Rs. 83,729.46, and Rs. 1,51,714.28 respectively depending on the interest rate in interest income over three years. This shows how a good interest rate can boost your savings. The difference in interest earned compared to the 5% scenario is substantial, especially at higher rates:

- At 8%, you earn Rs. 21,172.06 more in interest

- At 12%, you earn Rs. 49,666.96 more in interest

- At 20%, you earn Rs. 1,17,651.78 more in interest

This demonstrates the powerful effect of higher interest rates on savings growth over time, especially when combined with regular contributions.

Setting and Adjusting Savings Goals

Use the calculator to set realistic goals for different needs:

- Emergency fund

- House down payment

- Child’s education

- Retirement

Experts suggest saving 30% to 40% of your income. Adjust this based on your personal circumstances and goals.

Optimising Contributions for Desired Outcomes

Experiment with different contribution amounts to see how they affect your savings. For instance, increasing your monthly contribution from Rs. 10,000 to Rs. 12,000 could significantly impact your final savings amount.

Remember, a savings interest calculator is a guide. Use it to make informed decisions. But also consider other factors like inflation and market changes when planning your financial future.

Maximizing Savings with Advanced Features

Savings interest calculators have cool features to help you grow your money. They do more than just simple math. They help you plan your finances better.

Incorporating Additional Deposits and Withdrawals

Today’s calculators let you add regular money or take it out. This is great for saving for big things. For example, saving for a house deposit shows how monthly savings grow your money.

Factoring in Variable Interest Rates

Interest rates often change. Advanced calculators let you use these changes. This is key when looking at different savings options or planning for the future.

Exploring Different Compounding Frequencies

How often interest compounds matters a lot. Advanced calculators let you try different frequencies. This shows how often you get interest affects your savings.

| Compounding Frequency | Interest Accrued (5 years, 10% p.a., ₹100,000 initial deposit) |

|---|---|

| Daily | ₹61,617 |

| Monthly | ₹61,470 |

| Yearly | ₹61,051 |

Using these advanced features helps you plan better. You avoid mistakes in saving. This makes your financial decisions smarter.

Integrating the Calculator into Your Financial Plan

A savings interest calculator is a powerful tool in financial planning. It helps you align your savings goals with long-term financial objectives. By using this calculator, you can open a savings account and choose an investment option that best suits your needs and balance your savings with other financial commitments.

Aligning Savings with Long-Term Financial Goals

When planning for the future, it’s crucial to set clear savings goals. For instance, Mr. Rahul, a 21-year-old IT employee, used a savings calculator to plan his financial future. He chose a life insurance plan with a monthly premium of ₹10,000 for 10 years. The calculator helped him understand that this plan would provide a life cover of ₹20,98,750 and a guaranteed benefit of ₹20,80,120 over 15 years.

Balancing Savings with Investments and Expenses

A savings interest calculator helps you strike a balance between saving and spending. It allows you to determine how much you need to save each month to reach your financial goals without compromising your current lifestyle. This tool is particularly useful for planning big purchases or building an emergency fund over periods ranging from 5 to 20 years.

Periodic Review and Adjustment of Savings Strategies

Your financial situation and goals may change over time. Regular review of your savings plan is essential. Use the calculator to adjust your strategy as needed. This might involve increasing your monthly contributions or exploring different savings accounts with higher interest rates. By doing so, you ensure your savings plan remains effective in helping you achieve your evolving financial objectives.

Understanding the Limitations of a Savings Interest Calculator

Savings interest calculators are great for planning your finances. But, they have their limits. They give useful insights, but don’t show the whole picture of your financial future.

Not Accounting for Unforeseen Expenses

Remember, life is full of surprises. Interest calculators show growth based on your inputs. But, they can’t predict unexpected costs. For example, medical emergencies or job loss can affect your savings plan a lot.

External Factors Affecting Interest Rates

Interest rates change, and calculators work with current rates. Things like inflation can change these rates. In India, inflation often means your savings might not grow as much as the calculator shows.

Using the Calculator as a Tool, Not a Definitive Solution

Interest calculators are just one tool. Savings account rates can be tempting. But, big banks usually offer lower rates than online accounts. Look into money market accounts or certificates of deposit for better returns.

In short, use interest calculators as a first step. But, also do thorough financial planning and get professional advice. This will give you a clearer view of your financial future.

Conclusion

The savings interest calculator is a key tool for financial planning. It gives valuable insights into how savings can grow. This online tool helps people make smart choices about their savings and investments.

Empowering Your Financial Future with the Right Tools

Using a savings interest calculator lets investors use compound interest. Einstein called this the “8th wonder of the world” because it shows how savings can grow over time.

For example, putting ₹1,00,000 a year in an equity mutual fund with a 14% return can triple in around 13 years.

Taking the Next Steps Toward Financial Growth

Remember, the savings interest calculator is just the start. It’s important to think about inflation, market changes, and your goals. Talk to experts who can give you specific advice for full financial planning.

Using these tools regularly can help you save better. It’s the first step to a secure financial future. Start with informed choices, and the savings interest calculator will guide you.

FAQs:

Q: What is a savings account interest calculator?

A: A savings account interest calculator is an online tool that helps you calculate the interest you can earn on your savings account balance. It considers factors such as your initial deposit, annual interest rate, and time period to determine the total interest and final account balance.

Q: How can I use a savings account interest calculator?

A: To use a savings account interest calculator, input your initial deposit amount, the annual interest rate offered by your bank, and the time period for which you want to calculate interest. The calculator will then show you how much interest you have earned and your total savings over time.

Q: What’s the difference between simple interest and compound interest calculators?

A: A simple interest calculator calculates interest only on the principal amount, while a compound interest calculator factors in interest earned on both the principal and previously accumulated interest. Compound interest generally results in higher returns over time, especially for long-term savings.

Q: How often is interest calculated in a savings account?

A: The frequency of interest calculation depends on the bank and the type of savings account. Interest may be calculated daily, monthly, quarterly, or yearly. Many online savings account interest rate calculators allow you to specify the compounding frequency for more accurate results.

Q: Can I use an interest formula calculator to compare different savings accounts?

A: Yes, an interest formula calculator is a financial tool that can help you compare different savings accounts. By inputting the various interest rates and terms offered by different banks, you can find out how much interest you would earn with each account, making it easier to choose the best option for your financial goals.

Q: How do I calculate simple interest on a savings account?

A: To calculate simple interest on a savings account, use the formula: Interest = Principal x Rate x Time. For example, if you deposit ₹1,00,000 at a 3.5% annual interest rate for one year, the simple interest would be ₹1,00,000 x 0.035 x 1 = ₹3,500. Many online simple interest calculators can do this calculation for you automatically.

Q: What factors affect the interest rate on a savings account?

A: Several factors can affect the interest rate on a savings account, including the current economic conditions, the bank’s policies, the type of savings account, the account balance, and sometimes the length of time you commit to keeping your funds in the account. Higher balances and longer commitment periods often result in better interest rates.

Q: How can I maximize the interest on my savings account?

A: To maximize the interest on your savings account, consider the following strategies: shop around for high-yield savings accounts, maintain a higher account balance, choose an account with compound interest, look for promotional rates when you open a savings account, and avoid withdrawing money to allow your balance to grow consistently.

Q: Are online savings account interest calculators accurate?

A: Online savings account interest calculators are generally accurate, provided you input correct information. However, they may not account for all variables, such as changing interest rates or fees. Use them as a guide, but always verify the actual terms with your bank for the most accurate information about your specific savings account.

All these calculators and financial plans, and yet, nobody can predict the next market crash. Isn’t it all just a sophisticated guesswork?

🤔

Love how this article empowers us to make smarter financial choices for our wellness journey. Money saved is money earned for a healthier lifestyle!

I am glad that you find it useful 🙂

Interesting to think how future historians will study our online financial tools like these calculators. Will they see us as pioneers or naive optimists? 🤔

🤔

Using a savings interest calculator was a game-changer for me. Finally, I’m not just throwing money into an account and hoping for the best. Solid advice here.

I am glad that you find it useful 🙂

Oh great, another thing to remind me how my savings are basically just a fancy piggy bank. 😂

Lol, interesting

Do these calculators take inflation into account? It’s been my main concern with my retirement savings..

They usually don’t, as inflation rates change. Best to calculate separately and adjust your planning accordingly.

Modern calculators come with all capabilities and options, find the one that suits to your needs 🙂

Nice analysis on high-yield savings accounts. Been looking into those for some time now. This just makes the decision easier.

I am glad that you find it useful 🙂

Really appreciate the section on mistakes to avoid. It’s super helpful for someone like me who’s not too savvy with numbers. Excellent write-up, Vishal!

I am glad that you find it useful 🙂

Good breakdown on the types of savings accounts. Makes it easier to decide where to park my emergency fund.

I am glad that you find it useful 🙂

Imagine if we could get EXP points for saving money instead of interest, I’d be a financial wizard by now 🧙♂️

Lol 😀

hey can anyone tell me how these calculators handle taxes? cause i just started my first job and want to save right.

Modern calculators come with all capabilities and options, find the one that suits to your needs 🙂

Vishal, great piece on savings interest calculators. But how reliable are they when it comes to variable interest rates? My business savings fluctuate, and I’m wondering if these tools can adapt.

I’ve used a few of these calculators for my personal savings, and they do have options to adjust rates. Maybe checking the advanced features section could help?

Thanks, Anjali. I’ll dive into the advanced settings. Appreciate the tip!

Modern calculators come with all capabilities and options, find the one that suits to your needs 🙂